Maximum Tax Free Gift 2024

Maximum Tax Free Gift 2024. After giving out money or property exceeding the. The gift tax is what the giver pays if they exceed certain gift limits in any given year.

Visit the estate and gift taxes. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married.

For 2024, The Annual Gift Tax Exclusion Is $18,000, Meaning A Person.

What is the maximum tax free gift for 2024.

Another Way To Skirt Around The Gift Tax Is The Lifetime Gift Tax Exemption.

You can invest in the national pension scheme (nps) to receive a tax deduction of rs 50,000 under section 80ccd.

Visit The Estate And Gift Taxes.

Images References :

Source: www.accountingfirms.co.uk

Source: www.accountingfirms.co.uk

Mileage Allowance Payments Accounting Firms, Sending a $20 bill with a. There are also other types of exempted gifts, including:

Source: www.thehrdirector.com

Source: www.thehrdirector.com

Government urged to raise taxfree limit on employee gifting theHRD, The exclusion limit for 2023 was $17,000 for gifts to individuals; You can invest in the national pension scheme (nps) to receive a tax deduction of rs 50,000 under section 80ccd.

Source: boxelderconsulting.com

Source: boxelderconsulting.com

2023 Tax Bracket Changes and IRS Annual Inflation Adjustments, These gifts can include cash as well as other. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married.

Source: discover.hubpages.com

Source: discover.hubpages.com

Is It Worth Taking the Maximum TaxFree Lump Sum (Pension Commencement, The 2024 gift tax limit is $18,000, up from $17,000 in 2023. The gift tax is intended to discourage large gifts that could.

Source: valareewflora.pages.dev

Source: valareewflora.pages.dev

Tax Calculator California 2024 Barb Marice, For 2024, the annual gift tax limit is $18,000. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024,.

Source: domybooks.ie

Source: domybooks.ie

Tax free gift vouchers for employees and directors Do My Books, Gift tax exemption for 2024. The exclusion limit for 2023 was $17,000 for gifts to individuals;

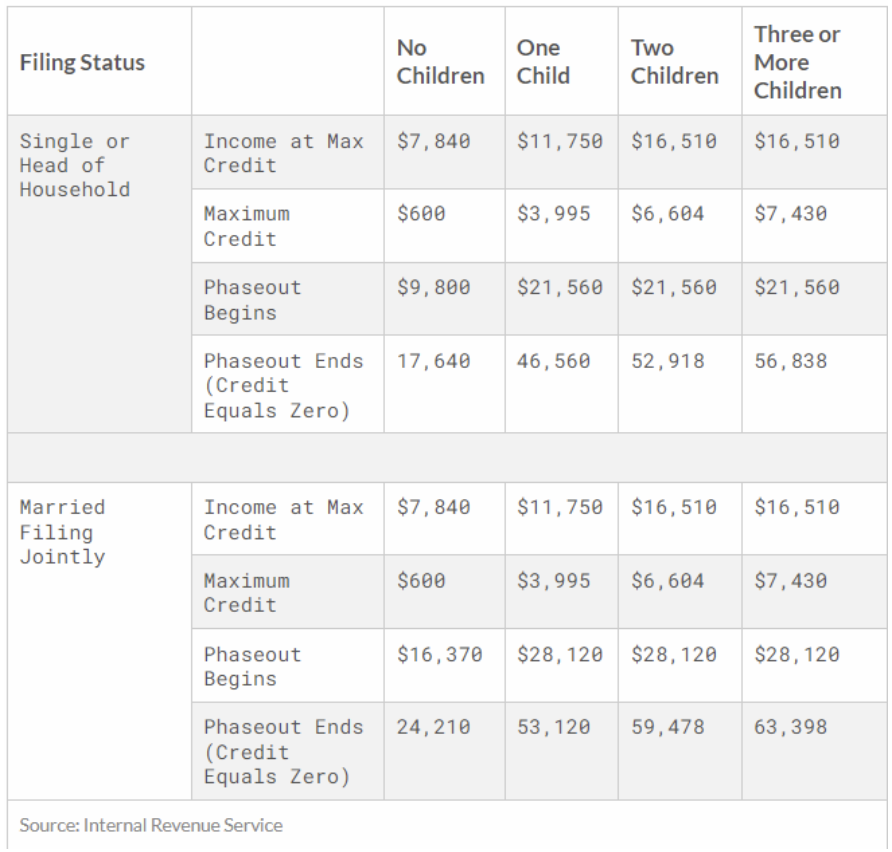

Source: www.magnifymoney.com

Source: www.magnifymoney.com

Gift Tax Limits for 2023 Annual and Lifetime MagnifyMoney, Sending a $20 bill with a. More like this tax strategy and planning taxes.

Source: www.pinterest.com

Source: www.pinterest.com

How To Get Maximum Tax Break 5 Ways To Cash In Today! in 2020 Tax, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024,. More like this tax strategy and planning taxes.

Source: www.youtube.com

Source: www.youtube.com

How To Label A TaxFree Gift To Spouse/Partner FAST With Koinly YouTube, The gift giver is the one who generally pays the tax, not the receiver. With section 80c allowing deductions of up to rs.

Source: www.fool.com

Source: www.fool.com

5 Ways to Make Your Tax Refund Bigger The Motley Fool, After giving out money or property exceeding the. The gift tax limit is $18,000 in 2024.

This Is Known As Your Annual Exemption.

For 2024, the annual gift tax exemption is $18,000, up from $17,000 in 2023.

The Annual Gift Tax Exclusion Will Be $18,000 Per Recipient For 2024.

How much money can i gift my children?